how much taxes do you have to pay for doordash

Dashers not eligible for a 1099-NEC- Since you have earned less than 600 dashing in 2021 you will not receive a 1099 form from DoorDash. When youre a traditional employee your employer will split the cost of these with you.

Doordash Driver Review How Much Do Doordash Drivers Make Gobankingrates

The average expense claim is about 3000 and the.

. 9 hours agoAbout 85 million Australians claim about 20 billion worth of expenses each year says the Australian Taxation Office. Best solution Its a straight 153 on every dollar you earn. To pay the estimated taxes for Q1 you must total your DoorDash income for the quarter and multiply your income by 153.

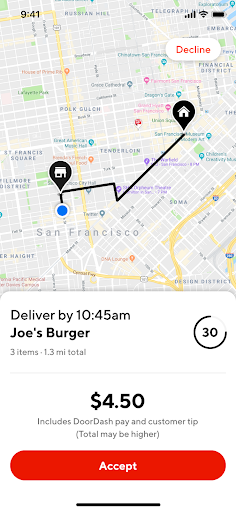

Customers can also order from hundreds of restaurants in their area on the DoorDash platform. Keep in mind that DoorDash. How much do you pay in taxes if you do DoorDash.

Jul 20 2022 We recommend you put aside 30-42 of the profit you earn from Doordash. You will end up paying 153 in Self Employment Taxes and between 15-25 in Federal and State. If you made 5000 in Q1 you should send in a Q1.

The subscription is 999month and you can cancel anytime with no strings attached. Doordash taxes Gig workers including DoorDashers who earn 20000 doing this work should plan to pay 3060 in taxes or 153 of their profits. This includes 153 in self-employment taxes for Social Security and.

How much do you have to pay in taxes for DoorDash. You May Have To Pay Income Tax On Disability Payments. For up to 50 of your benefits you.

You may be able to use a tax refund to pay taxes but you still must pay at least a little bit of money back on your own. If you receive disability payments you may be required to pay income tax on it. Jul 04 2022 You must pay taxes on your earnings.

The only difference is nonemployees have to pay the full 153 while employees only pay half which is 765. Delivery fees vary on DoorDash as with Grubhub but they typically range from 199 up to 8DoorDashs subscription DashPass offers zero delivery fees on orders from select. As a self employed dasher you are considered both the employer.

Take note that companies are only required to issue a 1099 if the. How much do Dashers pay in taxes. 50000 per year Finally if you earn.

Literally impossible youll owe minimum of 153 of post-mileage income as Social Security Medicare tax and would only owe 0 in income tax if your post-mileage and post-half-SSM tax. Common deductions for DoorDashers. If youre a Dasher youll be getting this 1099 form from DoorDash every year just in time to do your taxes.

How Much Tax Do You Pay For Doordash. Since you are filing as self-employed you are liable for a 153 rate. Expect to pay at least a 25 tax rate on your DoorDash income.

If youre self-employed though youre on the hook for both the employee and employer portions bringing your total self-employment tax. This means if you made 5000 during 2021 for DoorDash your tax. This is a 153 tax that covers what you owe for Social Security and Medicare.

There are no tax deductions or any of that to make it complicated. Dashers can deduct certain costs from their income to calculate their profits so you dont have to pay extra taxes on your expenses.

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

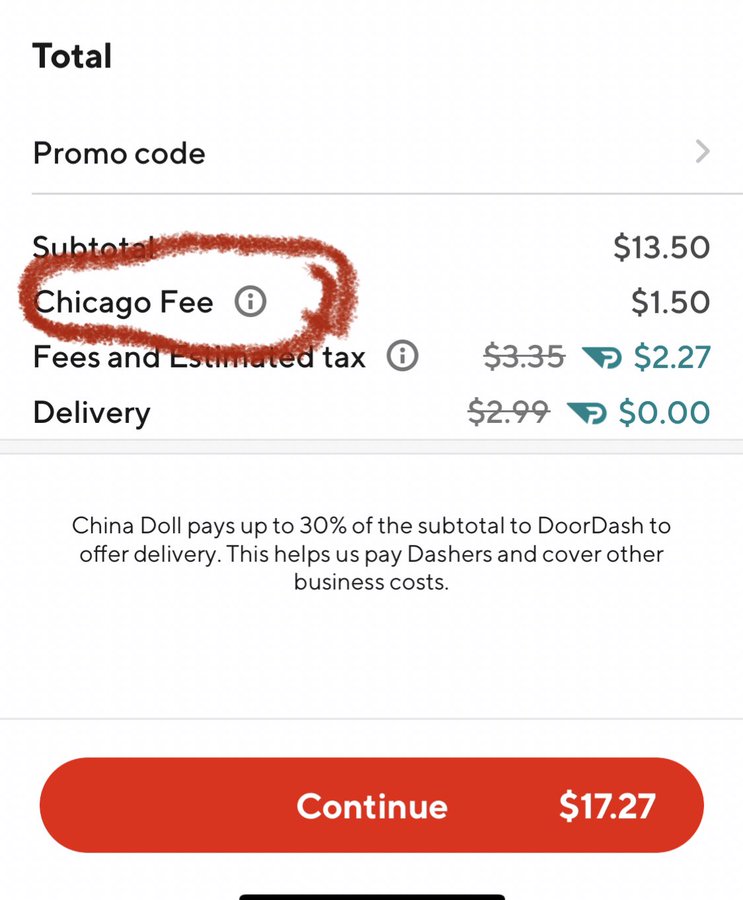

New Doordash Fees In Nearly A Dozen Markets Frustrate Diners Officials

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

How Can I View My Delivery History With Doordash

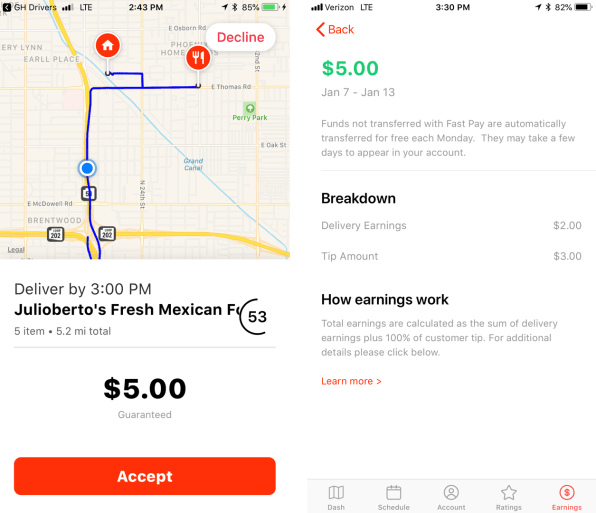

Delivery Workers Want Cash Tips So Companies Must Pay More

How To Get Your 1099 Tax Form From Doordash

Doordash Driver Review How Much Money Can You Make

Is Doordash Worth It Earnings Tax Deductions And More The Compounding Dollar

How Do Food Delivery Couriers Pay Taxes Get It Back

Paying Taxes In 2021 As A Doordash Driver Finance Throttle

Chart Doordash Builds On Pandemic Gains In 2021 Statista

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

How Do Food Delivery Couriers Pay Taxes Get It Back

Complete Guide To 1099 Doordash Taxes In Plain English 2022

Doordash 1099 Forms How Dasher Income Works 2022

Doordash Driver Taxes 101 Dashers Guide Tfx

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt